Creating a financial portfolio isn’t just for those with hefty paychecks. Even on a limited salary, you can increase your wealth. Setting aside at least 20% of your monthly salary for investments is a smart move that could pay off handsomely down the road.

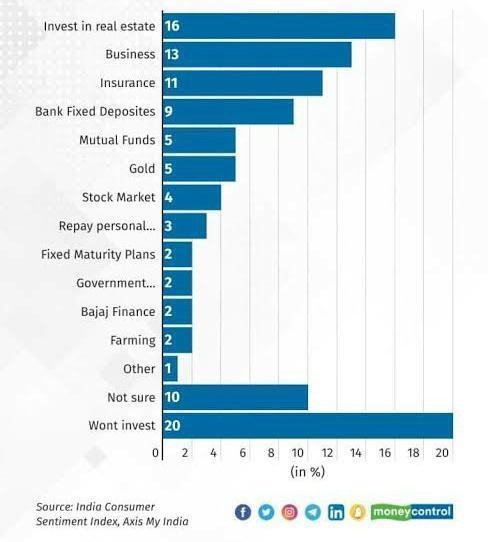

The investment landscape in India has been transforming. But there is still a long way to go in terms of participation in the financial markets. Imagine this – out of 10,019 people, from cities to quiet rural corners, a mere 16% put their money into investments last year. It’s quite an eye-opener, isn’t it?

Image Source: moneycontrol.com

As 2024 is just around the corner, there lies a vast opportunity for investors. Key sectors such as mobiles, white goods, automobiles and textiles are seeing export-led demand, making 2024 a pivotal year for their growth.

This opens up a significant window for online share trading and investment. Even individuals on a limited salary can now participate in India’s evolving financial landscape.

Why is it Important to Build a Portfolio?

Given the rising cost of living and life’s inherent uncertainties, diversifying your investments is essential. India’s projected consumer inflation rate in 2023-34 is about 5.4%. This means the purchasing power of your savings will decrease in the future.

A 2023 survey indicates that just 43% of adults in the US are yet to retire and believe they’ll have a comfortable retirement. This concern underscores the criticality of planning for retirement.

In response, schemes like the National Pension Scheme stand out. They have been delivering dependable yearly returns between 8-10% for the past decade. This shows the advantages of steady and regular investing for future financial security.

Possible Investment Options and Their Growth

Consider the following investment opportunities for their growth prospects:

| Investment Option | Investment Amount | Maturity | Taxation & Benefits | Risk Level | Returns Offered |

| Direct Equity | No Limit | No Lock-in | Taxed up to 15% STCG, LTCG over ₹1 lakh taxed at 10% | High Risk | Index average: 15-20% annually (Note: These are index returns) |

| Equity Mutual Funds | As low as ₹100 | No mandatory lock-in for most funds | Taxed up to 15% STCG, LTCG over ₹1 lakh taxed at 10% | High Risk | Index average: 15-20% annually (Note: These are index returns) |

| NPS | Min ₹1,000 annually | Till age 60 | Up to ₹2 lakh under Section 80C & CCD | Medium Risk | 8%-10% annually |

| ULIPs | Varies | 5 years | Up to ₹1.5 lakh under Section 80C | Medium to High Risk | Market-Linked |

| PPF | ₹500 – ₹1.5 lakh p.a. | 15 years | EEE category, Tax-Exempt | Zero Risk | 7.1% p.a. |

| SSA | ₹250 – ₹1.5 lakh p.a. | 21 years or on marriage | EEE category, Tax-Exempt | Zero Risk | 8% p.a. |

| KVP | Min ₹1,000, No Max | Varies | Interest taxable, No Section 80C | Zero Risk | 7.5% p.a. |

| SGBs | One gram gold price – 4kg gold p.a. | 8 years | Maturity amount tax-exempt, Interest taxable | Low to Medium Risk | 2.5% semi-annually |

Step-by-Step Guide to Building a Portfolio on a Limited Salary

Set Financial Goals: Whether it’s saving for retirement, buying a home, or funding education, define clear, achievable goals. This will guide your investment choices and timelines.

Create a Budget: A well-thought-out budget is your roadmap. It helps you live within your means while allocating funds for investment.

Asset Allocation: Distribute your investments across different asset classes such as equity, debt, and gold. This diversification can help balance risk and return in line with your goals.

Cost-Cutting Strategies: Opt for cost-effective investment avenues. For example, consider low-cost mutual funds or passive investments like ETFs or index funds. Keep an eye on fees, as these can eat into your returns.

Common Pitfalls to Avoid

- Herd Mentality: This refers to following the crowd into investing trends, which can lead to buying high and selling low.

- Overconfidence: Believing you can time the market or pick winners can lead to risky trades and losses.

- Loss Aversion: The fear of losses can lead to selling at the wrong time or not investing at all.

- Not Adjusting Your Portfolio with Age: As you age, your investment strategy should shift to reflect a more conservative stance to protect your nest egg. Opting for a portfolio manager should be a cost-effective choice, with the expense ratio ideally below 1%.

Final Thoughts

Remember, “The stock market is filled with individuals who know the price of everything, but the value of nothing,” as Phillip Fisher once said.

Navigating the financial markets can be complex, but platforms like Appreciate Wealth offer guidance to those looking to build their portfolios on a limited salary. With the right support, even the most budget-conscious investor can set the stage for a brighter financial future.

Author Bio : Yogesh is a Co-Founder at Appreciate, a fintech platform helping Indians achieve their financial goals through globally diversified one-click investing.